Tough Year for Ship Recyclers

Global market chaos continues post-Thanksgiving, reports cash buyer GMS. “Steel plate prices were the highlight of the entire sub-continent—and even China—where they unanimously retreated in unison this week, while the U.S. Dollar also decided to join in on the fun as it too retreated at all sub-continent locations (except—no surprise—Turkey).

“Making matters worse are the rising freight markets that continue to surprise the industry, as the Baltic Exchange’s Dry Index climbed another 3.2% through the course of the week, hitting a new high since December 2023 as practically every segment assisted in with the rising rates. Oil, meanwhile, remains at 21st-century lows, idling with marginal fluctuations, yet it closed the week out at USD 59.16/Ton—a near 14% drop over the last 12 months.”

Despite continued supply restrictions due to the widening net of sanctions and blacklists in addition to rising freight rates, both Bangladesh and India reported fresh arrivals and deliveries.

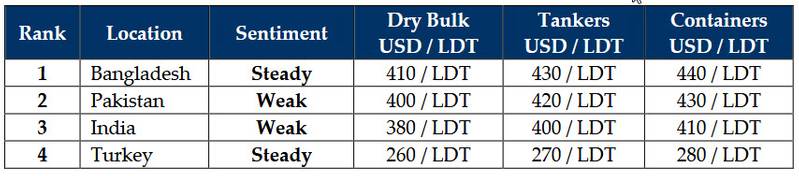

“Overall, as market fundamentals remain confidently uncertain, prices have endured a turbulent ride across the board over the last few months. USD 400/LDT+ remains a struggle to achieve in some markets as steel and currencies continue to underperform, alongside the deadly dearth of candidates that has plagued markets for about four years now, with only a handful of sales taking place to increasingly hungry recyclers—particularly in a resurgent Bangladesh, which led the way for sub-continent pricing for another week.

“Another four weeks and another trip around the sun means the industry continues hoping for a market resurgence in 2026. Tough year!”

GMS demo rankings / pricing for week 48 of 2025 are: