Germany’s Maritime Sector: Steady Growth Amid Global Headwinds

Order intake, exports, and green technology demand fuel confidence for 2025

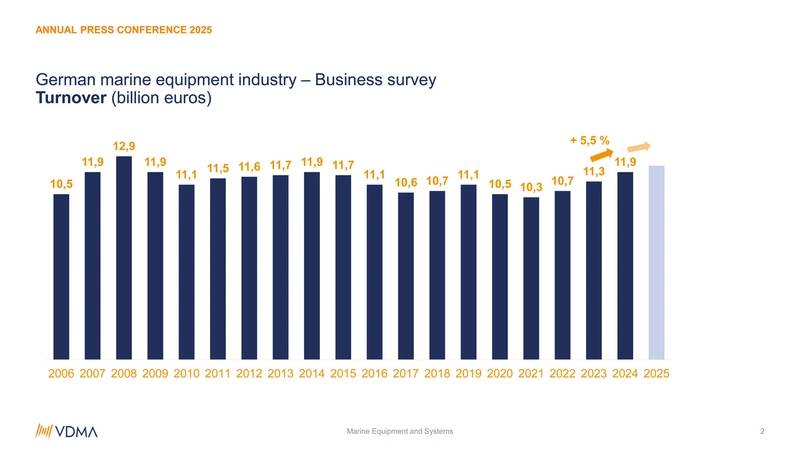

Germany’s maritime equipment and offshore supply industry is posting steady growth in 2024 and setting an optimistic course for 2025, according to new figures released by the VDMA Marine Equipment and Systems Association.

With an average turnover increase of 5.5% in 2024, German maritime suppliers are proving resilient in the face of global supply chain volatility, geopolitical tensions, and a fiercely competitive international market. The export share of the industry remains robust at 81%, underscoring Germany’s reputation for high-quality marine engineering and its strong integration into global shipbuilding supply chains.

“The industry is continuing its positive development despite global challenges,” said Martin Johannsmann, Managing Director of SKF Marine GmbH and Chairman of the Board of VDMA’s AG Marine Equipment and Systems. “The export strength is proof of our international competitiveness and the high demand for German maritime solutions.”

Aftermarket Services Hold Steady

After-sales services, including maintenance, repair, and spare parts, continue to play a key role in the sector’s performance, accounting for 27% of total revenues in 2024, a consistency that highlights the long-term nature of global shipping partnerships and the growing importance of lifecycle support in an era of digitalization and performance optimization.

Employment in the sector also showed modest gains, with the total workforce growing by 1.2% year-over-year to 65,000 as of mid-2025. While this is below the pace of revenue growth, it reflects ongoing productivity improvements and the introduction of more automated and digital solutions.

Solid Order Book

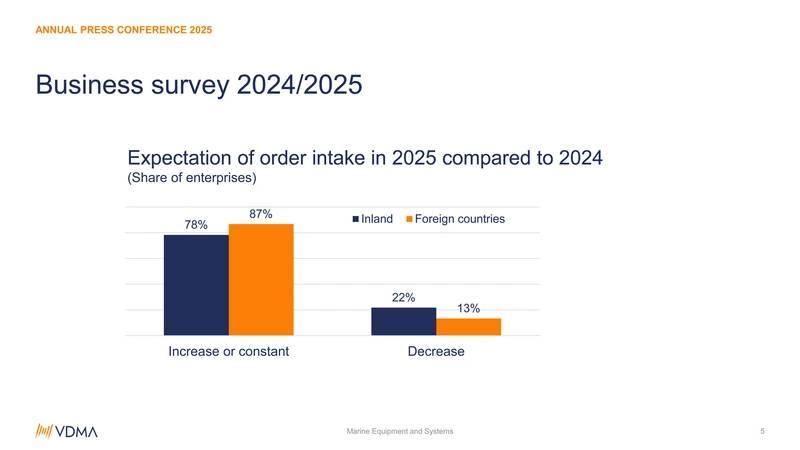

A critical driver of the upbeat outlook is the sustained strength in new order intake. The industry posted a 4.6% average increase in incoming orders in 2024—building on two years of already elevated demand. Looking ahead, nearly 80% of VDMA member companies anticipate stable or increasing order volume in 2025, with only a small minority expecting any decline.

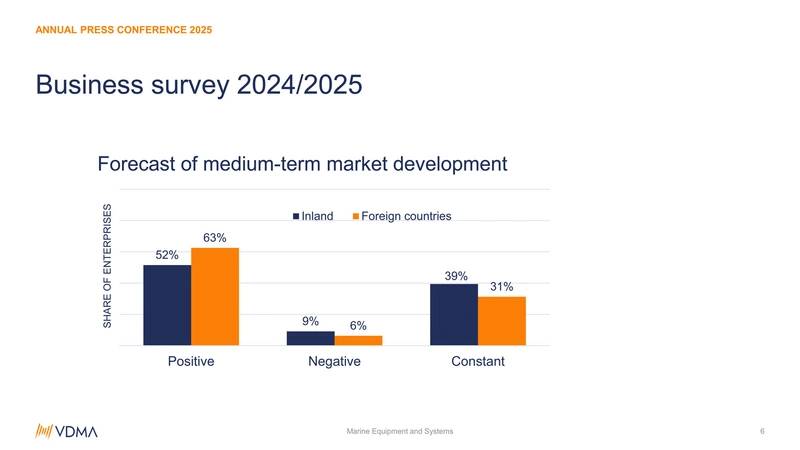

“Almost two-thirds of VDMA members expect the market to develop positively in the medium term,” said Dr. Volker Behrens, Managing Director of Schoenrock Hydraulik Marine Systems GmbH.

Strategic Focus: Europe, China, and Transformation

As German suppliers look to the future, several strategic themes are taking center stage:

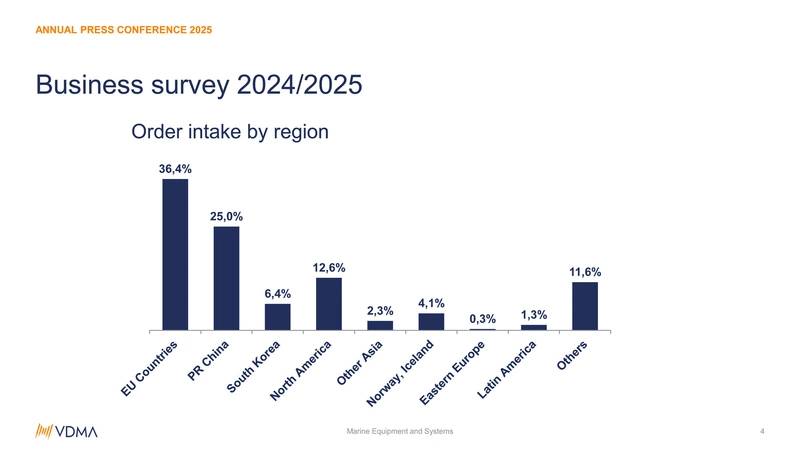

- European Integration: Roughly 36% of industry revenues are generated within Europe, reinforcing the importance of stable shipbuilding partnerships and intra-European cooperation.

- China Positioning: VDMA’s recently published China policy calls for fair competition and urges the German government to strengthen domestic and EU frameworks to support European suppliers.

- Bureaucracy Reduction: The Omnibus Regulation at the EU level has been welcomed as a long-overdue step toward reducing red tape and improving flexibility for internationally operating SMEs.

Green Technologies and Electrification in Focus

One of the clearest market drivers is the transformation of the shipping industry toward sustainable technologies. Maritime suppliers are rapidly expanding their offerings in energy-efficient propulsion systems, electrification, digital services, and intelligent integration.

“Even in our medium-sized company, the trend is clearly moving toward environmentally friendly technologies,” said Behrens. “We are moving away from hydraulics and toward electric drives for doors on both cruise ships and naval vessels.”

This shift aligns with broader decarbonization efforts across the maritime sector, as global regulations and customer demand increasingly favor sustainable ship design and operation.

Infrastructure Investment Supports Export Logistics

Finally, Germany’s special infrastructure fund—targeting overdue upgrades in roads, rail, and waterways—is also expected to play a key enabling role. Many of the industry’s export-heavy firms rely on efficient heavy-lift logistics to move components to ports and shipyards worldwide. Enhancements to this infrastructure could further enhance the sector’s competitiveness.

“Cautious Optimism”

While global shipbuilding faces headwinds, from inflation and supply chain strain to shifting geopolitical stressors, Germany’s maritime suppliers appear -positioned to navigate the storm. With resilient exports, a strong order pipeline, and a deepening commitment to sustainable technology, the VDMA’s member firms are setting a steady course into 2025 and beyond.