Commodity Report: Scramble to Import Copper Creates Market Imbalance

The collective scramble to move as much physical copper as possible to the U.S. before the imposition of import tariffs is creating shortages in the rest of the world.London Metal Exchange (LME) stocks have fallen to nearly two-year lows with time-spreads flaring into backwardation as inventory drains away.This tariff trade will continue until U.S. President Donald Trump's administration makes up its mind whether to add copper to the lengthening list of metals subject to penal import duties.The Section 232 investigation launched by the administration in February comes with a 270-day deadline.

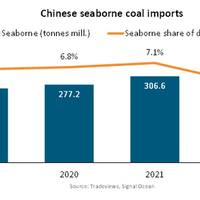

Chinese Inbound Coal Shipments Plummet 12.2%, Says BIMCO

Weak economic activity, a 10.5% increase in domestic coal mining, and a recovery in coal imports from Mongolia via rail alleviated coal shipments to China in 2022. However, the end of China’s zero Covid policy and an anticipated recovery of the Chinese economy have strengthened expectations for the country’s coal imports in 2023. A return of import tariffs, the end of China’s unofficial ban on Australian coal, and the energy transition in China could shape the coal shipment outlook.Coal shipments fell 12.2% in 2022…

Iron Ore Futures Fall as Chinese Demand Softens

Chinese iron ore futures fell below a key 1,000 yuan per tonne level on Thursday, falling more than 5% to their lowest in more than two months as domestic consumption remains sluggish on steel production controls.The most active iron ore futures on the Dalian Commodity Exchange, for September delivery, plunged as much as 5.6% to 999 yuan ($154.54) per tonne, their lowest since May 27. They were down 4.6% to 1,009 yuan a tonne as of 0322 GMT."Domestic consumption (for iron ore) is weakening significantly...