Seanergy Maritime Shares Q1 Results

Seanergy Maritime (SHIP), a pure-play Capesize shipping company, reported Q1 results and announced a quarterly dividend of $0.05 per share—marking the 14th consecutive quarterly dividend.

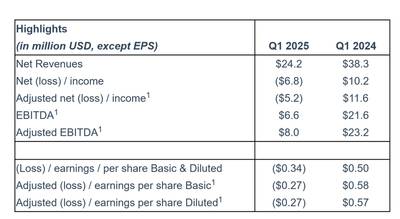

SEANERGY Q1:

- Fleet TCE2 of $13,403, outperforming the Baltic Capesize Index (“BCI”) by 3% in Q1 2025

- Declared $0.05 per share quarterly cash dividend – 14th consecutive quarterly dividend - Cumulative cash dividends of $2.26 per share, totaling $43.1 million

- $88.1 million in new financings and refinancings at improved terms and pricing

- Estimated fleet loan-to-value (“LTV”) below 50%; no significant maturities before Q2 2026

- Delivery of two Japanese vessels and commencement of period employments

“Following a year of record financial performance in 2024, Seanergy entered the first quarter of 2025 with a clear strategic focus: to remain well positioned to capitalize on the strong long-term fundamentals of the Capesize sector. We pursued this through selective fleet expansion—acquiring high-quality Japanese-built vessels—and through strategic refinancing transactions that enhanced our financial flexibility," said CEO Stamatis Tsantanis.

“Looking further into 2025, we have already secured roughly one-third of our operating days until the end of the year at an average daily rate exceeding $22,000. This forward coverage enhances visibility and provides a strong base for continued cash flow generation. Reflecting this and the improving market backdrop, our board has declared a discretionary dividend of $0.05 per share for the quarter—our 14th consecutive quarterly distribution—bringing total shareholder returns under our policy to approximately $43.1 million."