Domestic Shipbuilding Creates US Port Efficiency and Growth

On October 28, 2025 U.S. Senator Dan Sullivan (R-Alaska), Chairman of the Senate Committee on Commerce, Science, and Transportation’s Subcommittee on Coast Guard, Maritime, and Fisheries, convened the Senate hearing “Sea Change: Reviving Commercial Shipbuilding”. This hearing examined how to modernize and accelerate U.S. commercial shipbuilding while strengthening a larger maritime industrial base.

- Senator Sullivan opened with a statement that included: “Our nation faces a critical strategic challenge as foreign competitors, especially China, lead global shipbuilding while our domestic capacity remains very limited.”

- Senator Cruz followed with: “Our ports drive commerce, support thousands of jobs, and serve as a critical frontline for national security.”.

- Witness Sal Mercogliano offered comment on the “Ships Act”: “This legislation represents a critical step towards transforming the United States from a purely naval power into a true maritime power with a revitalized commercial sector.”

- Witness Matt Paxton, President, Shipbuilders Council of America presented testimony: “Domestic shipbuilding is not a preference, it is a necessity to preserve the capacity we may need in times of conflict. U.S. shipbuilders do not compete on a global level playing field. It is a market that is pervasive with non-market policies”

The Senators said it best.

Our domestic capacity remains very limited and our ports drive commerce. With tax and tariff issues affecting global trade those simple thoughts surrounding the container market can accelerate a change along our coasts and drive shipbuilding. Without domestic capacity and support of our ports, commerce stalls. There have been too many examples in recent years that prove the statement as fact.

The new shipbuilding “experts” talk about keeping pace with China. The far east shipyards build and deliver hundreds of ship designs. Tankers of all deadweights. Bulk carriers of all sizes, general cargo and gas. When building container ships, they don’t “pick” a ship size. They build what their ports and terminals require to move cargo to keep pace with their manufacturing base. In 1972 the largest container ship built was 2300 TEU – the Tokyo Bay. Our port systems now berth upwards of 24,000 TEU. That example alone defines far east growth and the task ahead of us.

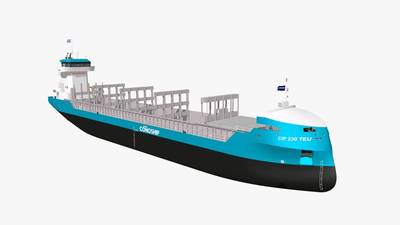

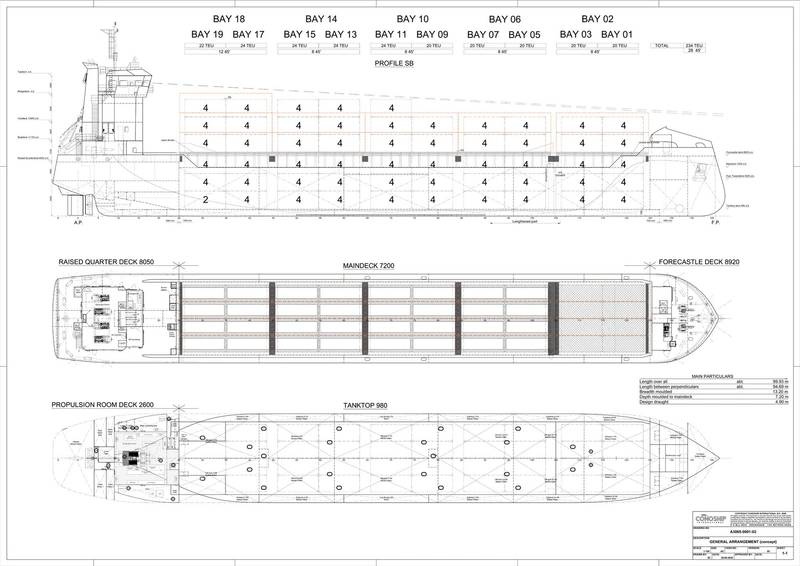

Image courtesy AMTECH

Image courtesy AMTECH

The Shipyard Shackles

Our growth is handcuffed by shipyard size and capacity.

The foreign designs range from Post Panamax at 24,000 TEU to feeders at 1200 TEU. Our past and present shipyard capacity was never developed to address that level of manufacturing pace. We built ships on a business model determining a capital cost of delivery and cost of operation. Port commerce did not drive the demand side and our recent capacity in “bluewater” tonnage addresses only noncontiguous domestic markets.

Port to Port U.S. coastal movements within the “short sea” concept were determined to be noncompetitive when compared to interstate trucking. Global movements under the Flag were limited to government programs. The Senate “expert” testimony unfortunately is correct.

U.S. shipbuilders do not compete on a global level playing field. Our market is pervasive with non-market policies. That said, the coastal movement of containerized cargo on the water was once a shipbuilding reality. Current commerce at the port and terminal level has been buried under foreign flag influence.

Our latest introduction of a domestic feeder project developed by Marathon Asset Management, Vega Reederei, and AMTECH, suggests to allow the U.S container ports and terminals determine what tonnage should be built to support their operation. Create a transition period to build vessel designs of a size that can be cost competitive, begin to correct our historical shipbuilding struggles and meet the needs of both our largest terminals and our smallest. This is a logistics issue and the future supply chain must address it with ship, rail and trucking.

The global system of transshipment utilizes road, rail and container feeder for cargo movements. The American system has a missing leg of the stool. We do not move container traffic from port to port on the water and the U.S. terminals large and small are asking for it. We have the support letters from several regions to identify the latest issues. A shortage of drivers, a shortage of available space to store the containers landed, the lack of available parking to support the chassis required to move the cargo out of the terminal. As this Administration works to understand the country requires a working waterfront, a revitalized manufacturing base will produce new highway and rail congestion areas. The smaller terminals will turn to the distribution of waterborne coastal cargo movements to solve these problems. Their draft and size restrictions can be alleviated with a series of smaller feeders.

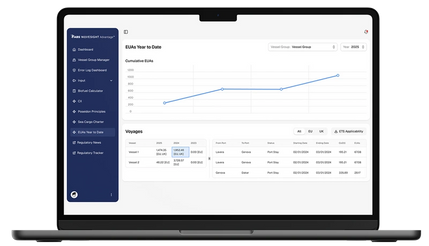

Image courtesy AMTECH

Image courtesy AMTECH

The Coastal Feeder

Marathon Asset Management has recently increased investments in its U.S. Flag coastal fleet and have supported Vega Reederei in their deliveries of a Conoship design in Europe. Vega Reederei is a German feeder shipping company founded in 1919, headquartered in Hamburg, that has ordered ten new, environmentally friendly, diesel-electric coaster vessels to re-enter the European short-sea market. Amtech is bringing their extensive experience in US, Korean and Chinese ship construction supervision and design integration to the partnership.

The coastal feeder design is fully vetted by Class and modeled. More than several vessels have been delivered and operating in Europe under container and dry bulk applications.

The vessels feature a new hull design at 3,800 dwt, large diameter propeller, and fuel-saving ConoDuctTail and can be upgradable to full-electric propulsion if required. The current design is under review to fit U.S. shipbuilding capabilities and several regional ship builders have been provided specifications to collect comments, confirm supply chain & sustainability issues prior to the build and develop contracts. The project will be a series build.

The current vessels operate with a nine-man crew. To understand the design and construction the vessels are available for attendance in Europe. Dual use capability to support domestic military movements and national security will be included in the design review and terminal discussions.

The development of a new port to port ecosystem needs to be established as this Administration works to revive the American Manufacturing base. A system to move large numbers of containers to export terminals will become as important as addressing the existing port congestion of imports. This project is more than a Marad Marine Highway discussion of highway congestion. It is not a negotiation with foreign container lines comparing truck costs to waterborne cargo movements while repositioning cargo along the U.S coasts or within the Great Lakes. It is placing transportation as an important detail in the rebuilding of an American Supply chain and manufacturing base.

BIMCO reported the nine largest U.S. container ports grew by 1.7% year-over -year to 16.9 million TEU in the first half of 2025. Export volumes declined by 4.2%. This shipping sector will continue to be influenced by tariffs, taxes, Artic route development, alternative fuels and geopolitical events. The Marathon Container Feeder project redistributes that 16.9 million TEU as a pure logistics model and supported by Marathon Assets Management investments in Rail, cranes, terminal and ships along with years of Vega Reederei’s “short sea” experience. Shipbuilding gets a chance to ride along.