Study: IMO’s Net Zero Framework Favorable for Ammonia

A study shows that under the parameters principally agreed within the IMO Net Zero Framework, ammonia dual-fueled ships have a clear competitive advantage from the mid-term (mid-2030's), while the near-term landscape remains less certain.

The study was released by UMAS and UCL Energy Institute Shipping and Oceans Research Group and undertaken for Global Maritime Forum.

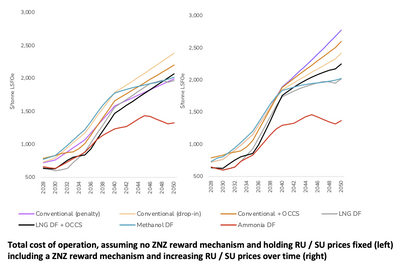

The report uses a Total Cost of Operation (TCO) modelling approach to assess the relative competitiveness of various fuel and ship technology options. The analysis highlights both the clarity provided by the IMO’s fuel standard and remedial unit pricing and the uncertainties surrounding key aspects like zero and near zero fuel rewards and the dynamics of the surplus unit trading market.

Dr Tristan Smith, Professor of Energy and Transport at the UCL Energy Institute, said: “Many stakeholders were waiting for clarity from IMO in order to take decisions. Although there are significant complexities and uncertainties in what was agreed in April, even conservative projections of how remaining policy details will be finalized results in a ‘no brainer’ choice for shipowners in dual fuel ammonia. However equivalent clarity is not available for producers of fuels, particularly e-fuels. This analysis indicates it’s likely that key investment decisions for e-fuels will await a strong outcome from the IMO policy debate on the zero and near zero reward mechanism, unless they are supported by other opportunities or governments.”

The analysis shows ammonia duel-fueled ships have a clear competitive advantage from at least the mid-term (mid-2030's) onwards and create the broadest optionality for least cost compliance in the short-term. When considering the likely specifics of the reward mechanism, the potential for e-ammonia to be a competitive compliance pathway is even earlier, from 2028 onwards.

The TCO analysis indicates that the strategy to only own conventionally fueled tonnage is now uncompetitive in both the short-term and certainly the mid-term – as well as constraining opportunities to benefit from reward revenues.

LNG will initially hold a competitive advantage over alternative fuel choices during the early transition period. Despite any early dominance LNG may achieve in the late 2020s, its prospects become more challenging by the early 2030s. LNG's relatively high emissions intensity presents a fundamental constraint—it cannot generate sustainability units without onboard carbon capture and storage technology.

Consequently, LNG dual-fuel (DF) ships must rely on either lower-emission drop-in fuels (such as bio-LNG, bio-marine gas oil or e-LNG) or accept penalty costs. This dependency, combined with uncertainty surrounding future gas prices and abatement cost differentials compared to other alternatives, can significantly weaken the incentive signals for LNG adoption.

The report indicates that infrastructure investment should focus on ammonia capacity development while preparing for potential rapid scaling, particularly as LNG demand may contract quickly after an initial surge. The analysis reveals mixed signals for different fuel producers, with conventional and LNG producers facing significant demand uncertainty, while biogenic fuel producers receive clearer positive signals if they can achieve competitive pricing.